Security Deposit Automation

Fully remote W9 and account set up

Automatically send interest and forms

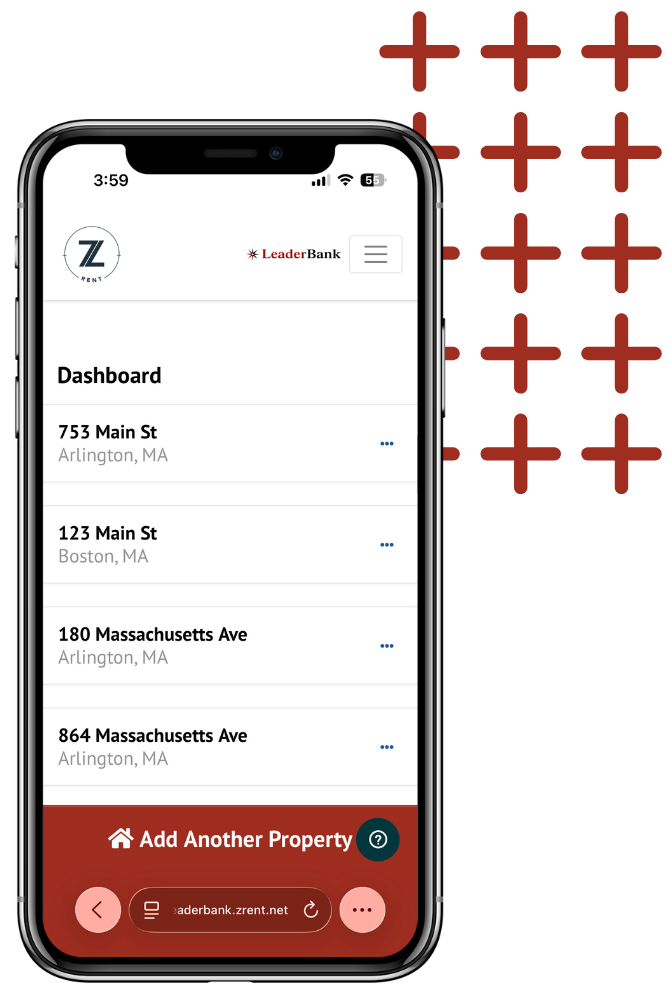

Mobile deposit and deductions

MA state compliance protection

Automatic Rent Collection

Automatic monthly rent collection

Allow tenants to pay with ease

Simplify your rent roll records

No need for checks or Venmo

Property Management Banking Solutions

Zeugma Plus

Landlords can maximize their property income with a high yield savings account that pairs with checking for the opportunity to qualify for cash back and other rewards**. 4.75% APY* on savings balances up to $250,000.

Business Banking

Ideal for property management firms looking for innovative solutions with the technology and convenience of a large bank and the personal touch of a community bank.

1031 Exchanges

The Leader1031*** Qualified Intermediary team has decades of industry experience helping real estate professionals use the tax-deferred advantages of Section1031 exchanges.

Property Management Lending Solutions

Mortgages

Looking to purchase a property? Our expert loan officers are ready to help you achieve your business goals. Take the first step by getting a customized mortgage rate quote.

Refinancing

Mortgage holders can take advantage of lower rates by refinancing to enjoy a lower monthly payment or to use hard-earned equity to accomplish a range of business goals.

Business Lines of Credit

Perfect for short-term cash flow needs, financing inventory and accounts receivable with a secured basis at a floating rate tied to the Wall Street Journal Prime Rate.

Meet Our Team

*Annual Percentage Yield (APY) effective as of 19 February, 2026. To open a new Zeugma Plus account relationship, you must make a total initial deposit of $1,000.00 using funds drawn from outside Leader Bank. Your Zeugma Plus Accounts must each be funded with a minimum of $10.00, the minimum balance required to maintain eligibility. To receive the 4.75% APY quoted, you must fulfill the following 3 requirements for your Zeugma Plus Checking each month: (a) receive a minimum of $1,000 in direct deposits, (b) enroll in eStatements, and (c) have three (3) electronic withdrawal debit transactions posted and cleared (excluding internal transfers) (the 'Qualifying Criteria'). When you satisfy the Qualifying Criteria, then an APY of 4.75% shall be paid on Zeugma Plus Savings balances up to $250,000 in the following month. An APY of 2.50% will be paid on that portion of daily balances which exceed $250,000; your total APY for such balances will range from 2.50% to 4.75%, depending on total balance. If you do not meet the Qualifying Criteria in a month, you will be paid 2.50% APY on your entire balance in the following month. The APYs above are effective for accounts opened between 10/1/25 and 11/30/25 and shall not be changed for accounts opened in this timeframe until at least 03/31/26; thereafter APYs may vary. Limit one Zeugma Plus Checking and one Zeugma Plus Savings account per household; additional terms and conditions may apply.

**Eligible Zeugma Plus Checking accounts that meet the Qualifying Criteria will be reimbursed up to $15 per month in ATM surcharges assessed by other banks and will receive debit card cash rewards of 1% on 'Qualifying Purchases' per month. 'Qualifying Purchases' include signature transactions only where the client selects 'credit' as the transaction type. Transactions made at, with, or through the following vendors will not be counted towards the minimum number of debit transactions requirement for Zeugma Plus or receive the 1% cash back regardless of if it is a transaction where 'credit' is selected as the payment type: Google Wallet, PayPal, Venmo, Square Cash, MoneyGram, or any other cash transfer, wire transfer or payment made through any money movement app, website, vendor or institution. Bonuses are subject to IRS tax reporting requirements IRS 1099-MISC.

***Leader1031.com, LLC ("Leader1031") is a wholly owned subsidiary of Leader Bank, N.A. This website is provided as general information only and should not be taken as legal, investment or other professional advice. This content of this publication shall not be construed as a recommendation to participate in any particular trading, financial or investment strategy, and neither Leader Bank, NA nor Leader1031.com, LLC can provide legal or tax advice concerning the specific tax consequences of a given transaction. Any action that you take as a result of information or opinions provided in this publication is ultimately your responsibility. Consult your attorney or tax professional before making any investment or financial decisions.