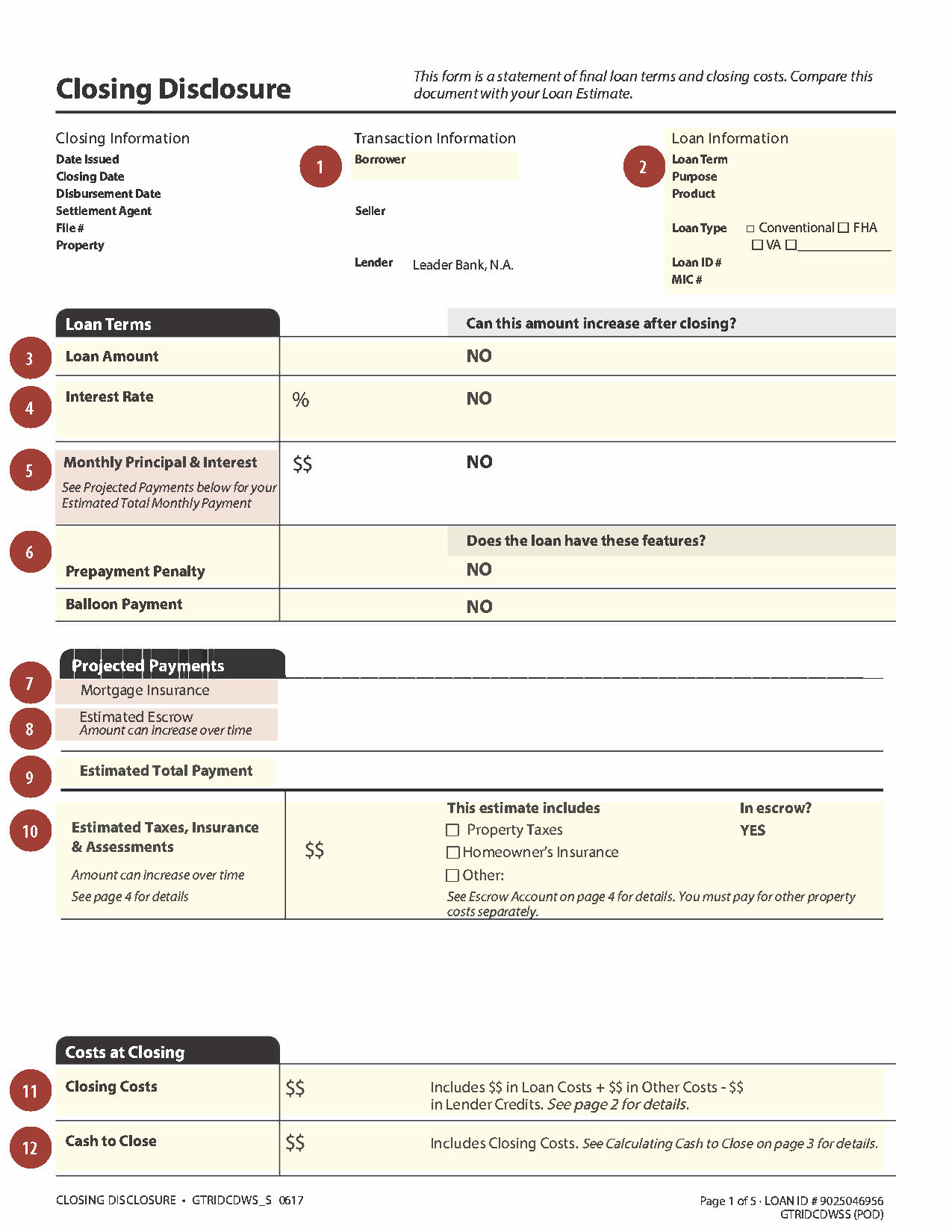

How to Read a Mortgage Closing Disclosure

The Closing Disclosure is a document provided by your lender in the days prior to your closing outlining everything from your loan amount, interest rate, closing costs, and more.

What's in a Mortgage Closing Disclosure?

The various sections of a mortgage closing disclosure are detailed below.

1. Double check to ensure your name is spelled correctly and that your contact information is listed correctly to avoid any issues later in the process.

2. Make sure that the loan information listed here is what you discussed with your loan officer.

3. Take the time to do some quick math and make sure your loan amount listed here plus your down payment amount totals the sale price of the home you're buying. If this amount has increased, be sure to check with your Loan Officer to see whether any of your closing costs have been rolled into your loan amount.

4. This column will indicate what interest rate you'll be paying on your loan as well as whether your loan is fixed or adjustable. If the right-hand column here says yes then your rate is adjustable and can change after closing.

5. This field indicates the amount of principal (who much you're borrowing) plus the amount of interest (the amount the Bank is charging you for lending the money) you'll pay each month. Again, if the right-hand column says yes then your monthly payment amount could change after closing.

6. If this column says yes then you'll be charged a fee for paying off your mortgage early. Details of how the fee will be calculated will be included.

7. If your down payment is less than 20 percent of the purchase price of the home, you'll be required to pay mortgage insurance on your loan.

8. Your estimated escrow represents additional charges in your monthly payment including property taxes and homeowners insurance.

9. This figure represents the total payment you can expect to make each month, including mortgage insurance, taxes, and homeowners insurance.

10. This field will include any taxes, insurance, and assessments in escrow as well as any items that are not escrowed.

11. Your closing costs are the upfront charges you'll pay at closing in order to obtain your mortgage and officially transfer ownership of the property.

12. This is the amount of cash you'll need to have on hand at closing, and includes your closing costs. This payment Is generally made by cashier's check or wire transfer, and you'll need to provide your lender with proof of the source of these funds.

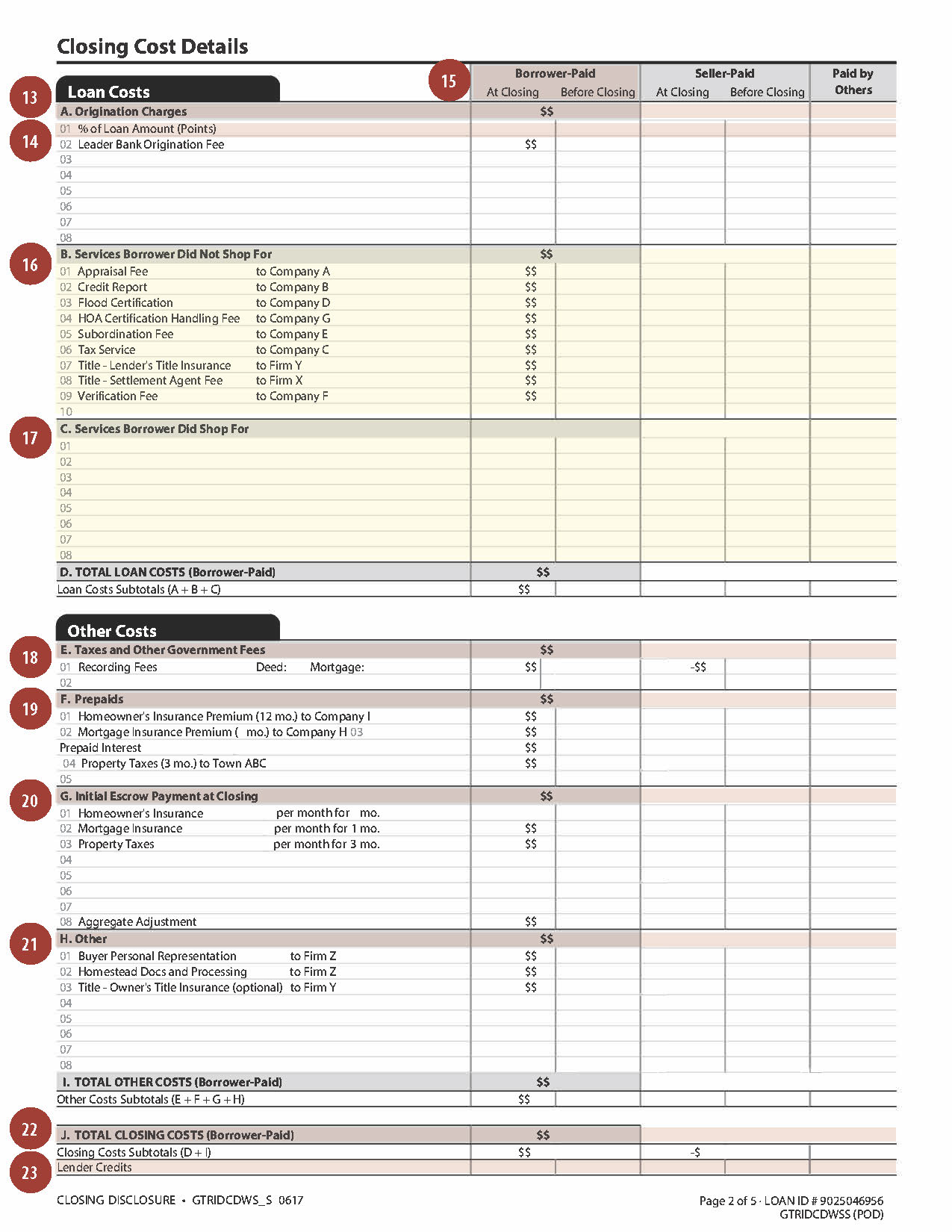

13. Origination charges are upfront fees charged by your lender as part of your closing costs.

14. Points are an optional upfront fee in which you pay your lender for a lower interest rate.

15. This column lists the costs that will be charged to you at closing.

16. The services outlined in this section are chosen by your lender and required to obtain a loan from them. Compare these to the Services You Cannot Shop For section of your Loan Estimate to make sure there are no new services listed that weren't on your Loan Estimate form.

17. Any services you shopped for separately will be listed here. Make sure you recognize all of the services and providers listed here, and if anything seems out of place be sure to ask your Loan Officer for an explanation.

18. This section outlines additional costs associated with your transaction necessary to complete the transfer of property.

19. This section lists interest accrued on your loan between the time you close and the end of that month. You'll also see the prepayment for your first year's homeowners insurance premium listed here (to be paid in advance at closing).

20. The figures in this section show you what insurance and tax costs are due at closing. This payment will establish an initial balance in your escrow account.

21. Any other services you've chosen will be listed here. Double check that any amounts listed here match your expectations.

22. This figure is the total upfront cost of your loan transaction excluding your down payment. It's worth noting that this is different than the total amount due at closing, which is called Cash to Close.

23. If you received a rebate or credit from your lender to offset some or all of your closing costs, that figure will be represented here.

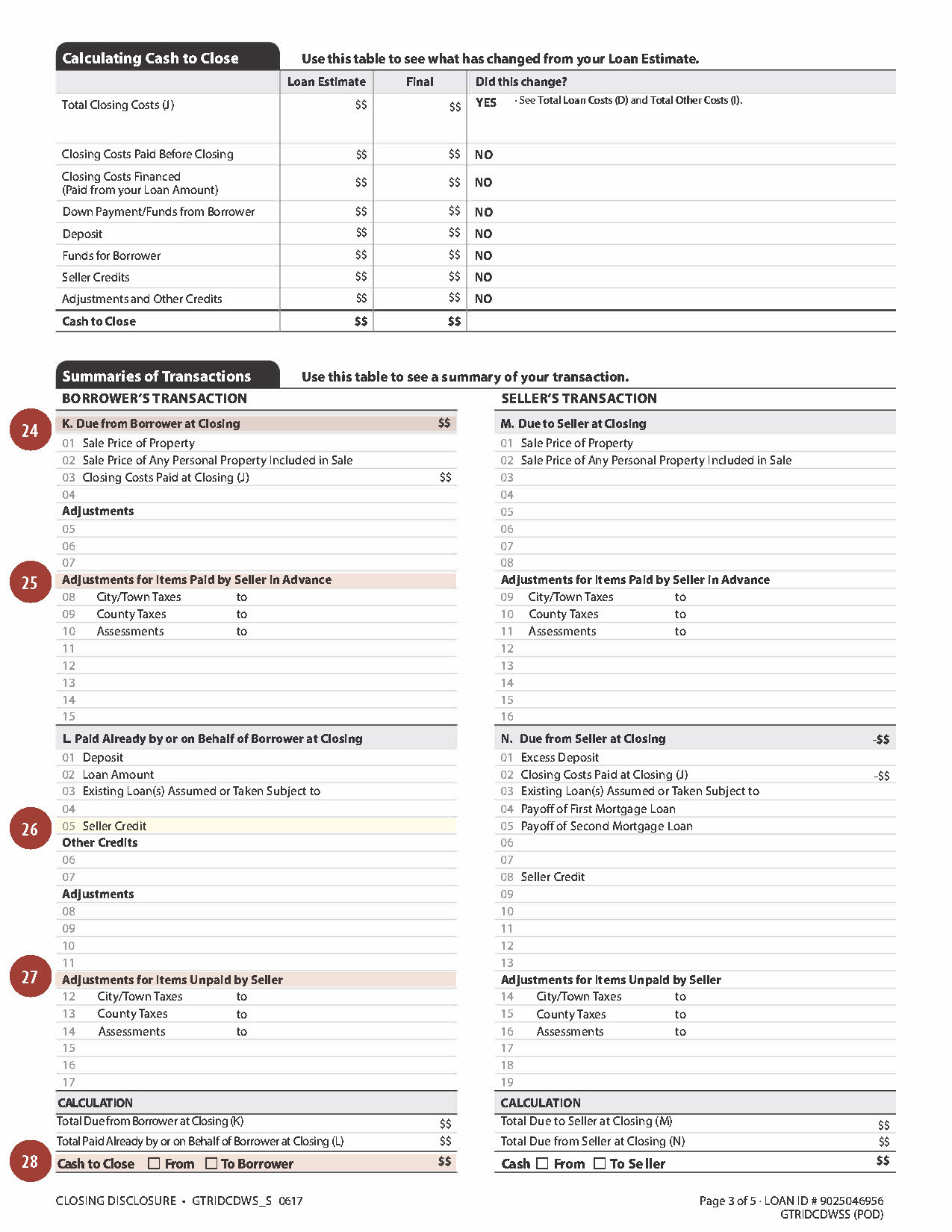

24. This is the amount you will be charged at closing including the price of your new home and any closing costs. This figure does not include closing cost credits or rebates.

25. Any costs that have been paid by the seller that you need to reimburse them for will be listed here.

26. A seller credit is an amount a seller has agreed to put toward your closing costs.

27. These are prior taxes or fees owed by the seller that you will be accountable for paying in the future. This is the amount the seller is reimbursing you for now to cover these future expenses.

28. This is the actual amount of money you will need to pay at closing by a cashier's check or wire transfer. Your closing agent will be able to give you more information about how this payment should be made (usually by settlement agent, escrow agent, or closing attorney).

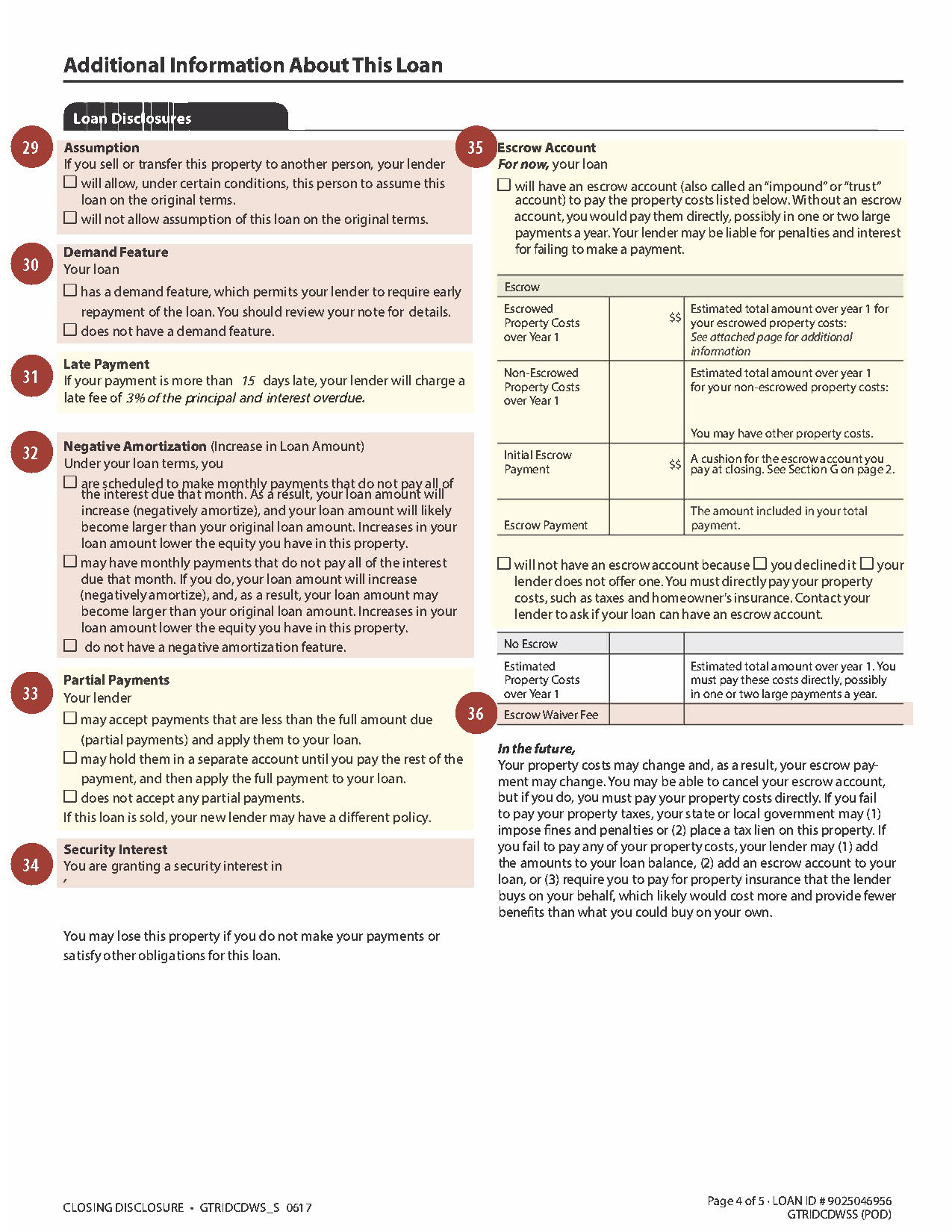

29. An assumption indicates that if you sell your home the buyer can take over your loan on the same terms. Most loans do not have assumptions.

30. A demand feature means your loan allows your lender to demand immediate payment of the entire loan at any time.

31. Any fees for making a late payment on your loan will be outlined here.

32. Negative amortization means your loan balance can increase even if you make on time and in full payments. Most loans do not have negative amortization.

33. This section indicates whether your lender will accept partial payments in a given month and how they will handle any partial payments.

34. Security interest allows your lender to foreclose on your home if you don't pay back the money you borrowed to purchase the home.

35. An escrow account is where you pay your homeowner's insurance and property taxes each month as part of your mortgage payment. Outlined here you'll see whether you have an escrow account, what expenses are being paid into the escrow account, and the associated costs.

36. You may be assessed a few if you choose to move forward without an escrow account.

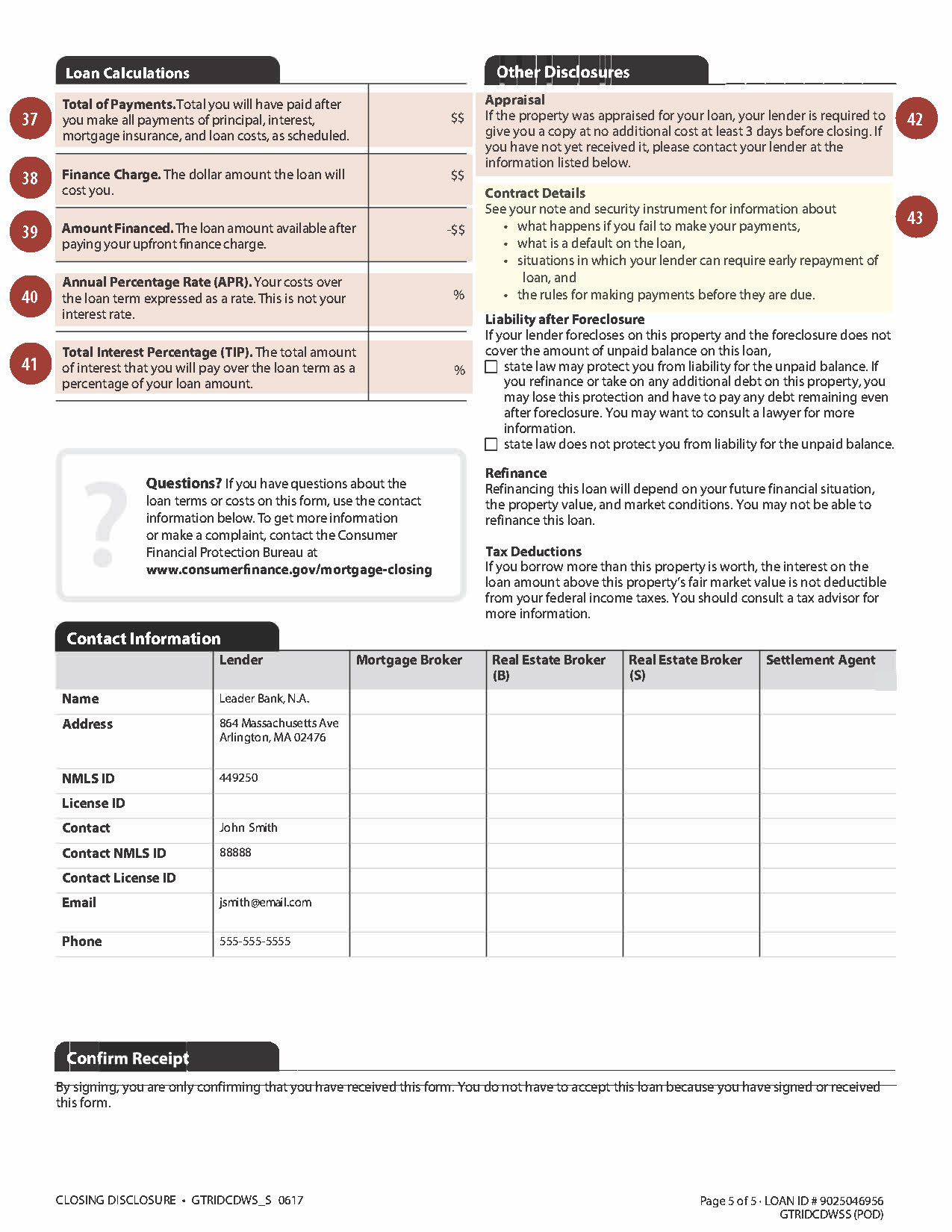

37. This figure represents the total amount you will pay over the life of your loan if payments are made as scheduled.

38. The total amount of interest and loan fees you will pay over the life of your loan if payments are made on schedule.

39. This is the net total you are borrowing from the lender not including most of the upfront fees the lender is charging you.

40. APR represents one measure of the cost of your loan.

41. Total Interest Percentage which indicates how much interest you'll pay over the life of your loan. It can helpful when you're comparing loan offers from different lenders.

42. An appraisal will be conducted by your lender to determine the value of the property. You'll receive a copy of the appraisal report once completed.

43. It's important to review this section and review your note and security instrument for more information about various scenarios dealing with what happens if you fail to make payments on time, what happens if you default on your loan, and more.