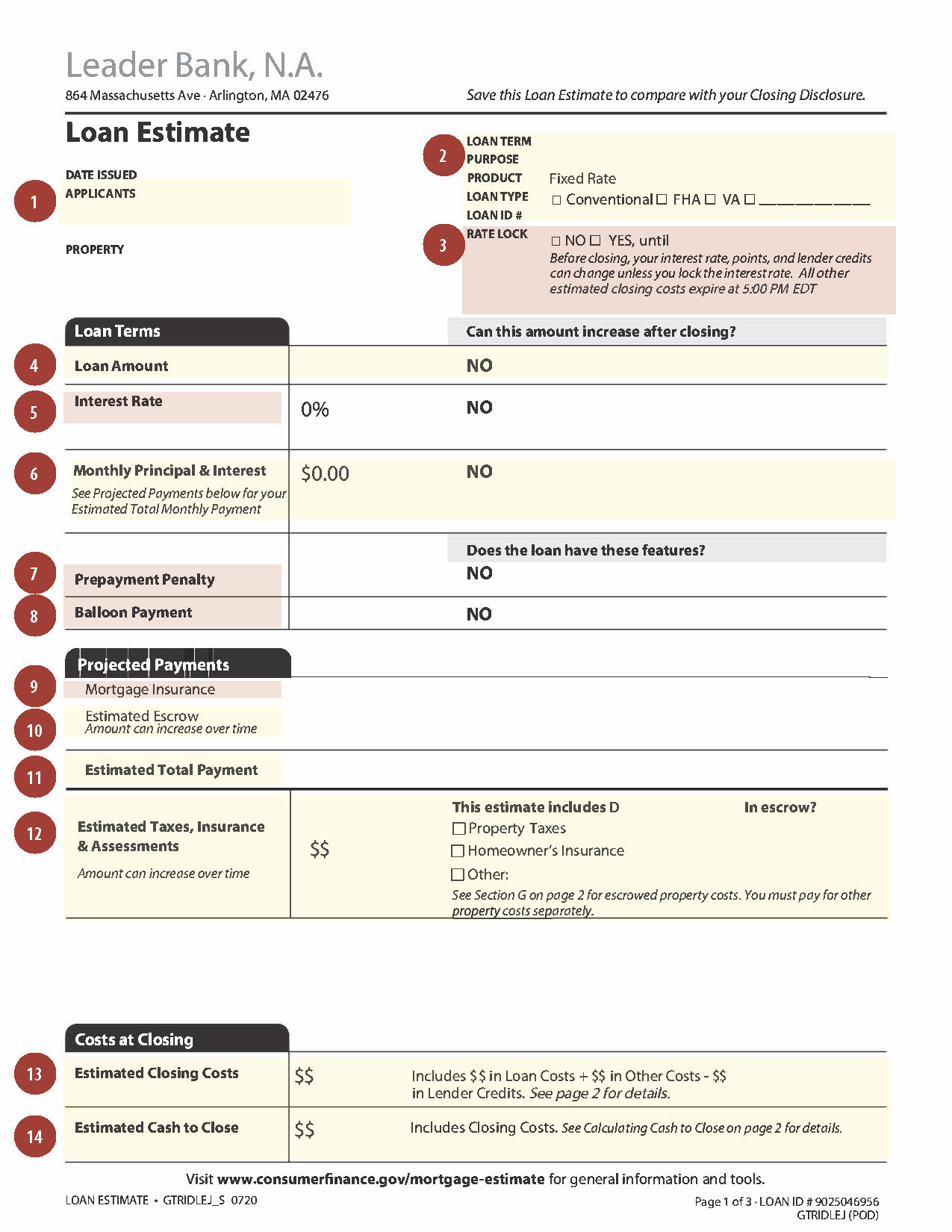

How to Read a Mortgage Loan Estimate

A loan estimate is an important part of the mortgage process outlining the details of your loan.

What's in a Mortgage Loan Estimate?

Information contained in the Loan Estimate ranges from personal information about yourself to detailed line items outlining the specific costs of your loan. The various sections of a mortgage loan estimate are detailed below.

1. Double check to ensure your name is spelled correctly and that your contact information is listed correctly to avoid any issues later in the process.

2. Make sure that the loan information listed here is what you discussed with your loan officer.

3. If your rate was locked by your lender make sure it is indicated as such here with the correct date.

4. Take the time to do some quick math and make sure your loan amount listed here plus your down payment amount totals the sale price of the home you're buying.

5. This column will indicate what interest rate you'll be paying on your loan as well as whether your loan is fixed or adjustable. If the right-hand column here says 'YES' then your rate is adjustable and can change after closing.

6. This field indicates the amount of principal (who much you're borrowing) plus the amount of interest (the amount the Bank is charging you for lending the money) you'll pay each month. Again, if the right-hand column says yes then your monthly payment amount could change after closing.

7. If this column says yes then you'll be charged a fee for paying off your mortgage early. Details of how the fee will be calculated will be included.

8. A balloon payment indicates that your final mortgage payment will be a lump sum larger than your regular monthly payments. If this column says yes, your loan contains a balloon payment.

9. If your down payment is less than 20 percent of the purchase price of the home, you'll be required to pay mortgage insurance on your loan.

10. Your estimated escrow represents additional charges in your monthly payment including property taxes and homeowners' insurance.

11. This figure represents the total payment you can expect to make each month, including mortgage insurance, taxes, and homeowners' insurance.

12. This field will include any taxes, insurance, and assessments in escrow as well as any items that are not escrowed.

13. Your closing costs are the upfront charges you'll pay at closing in order to obtain your mortgage and officially transfer ownership of the property.

14. This is the amount of cash you'll need to have on hand at closing, and includes your closing costs. This payment Is generally made by cashier's check or wire transfer, and you'll need to provide your lender with proof of the source of these funds.

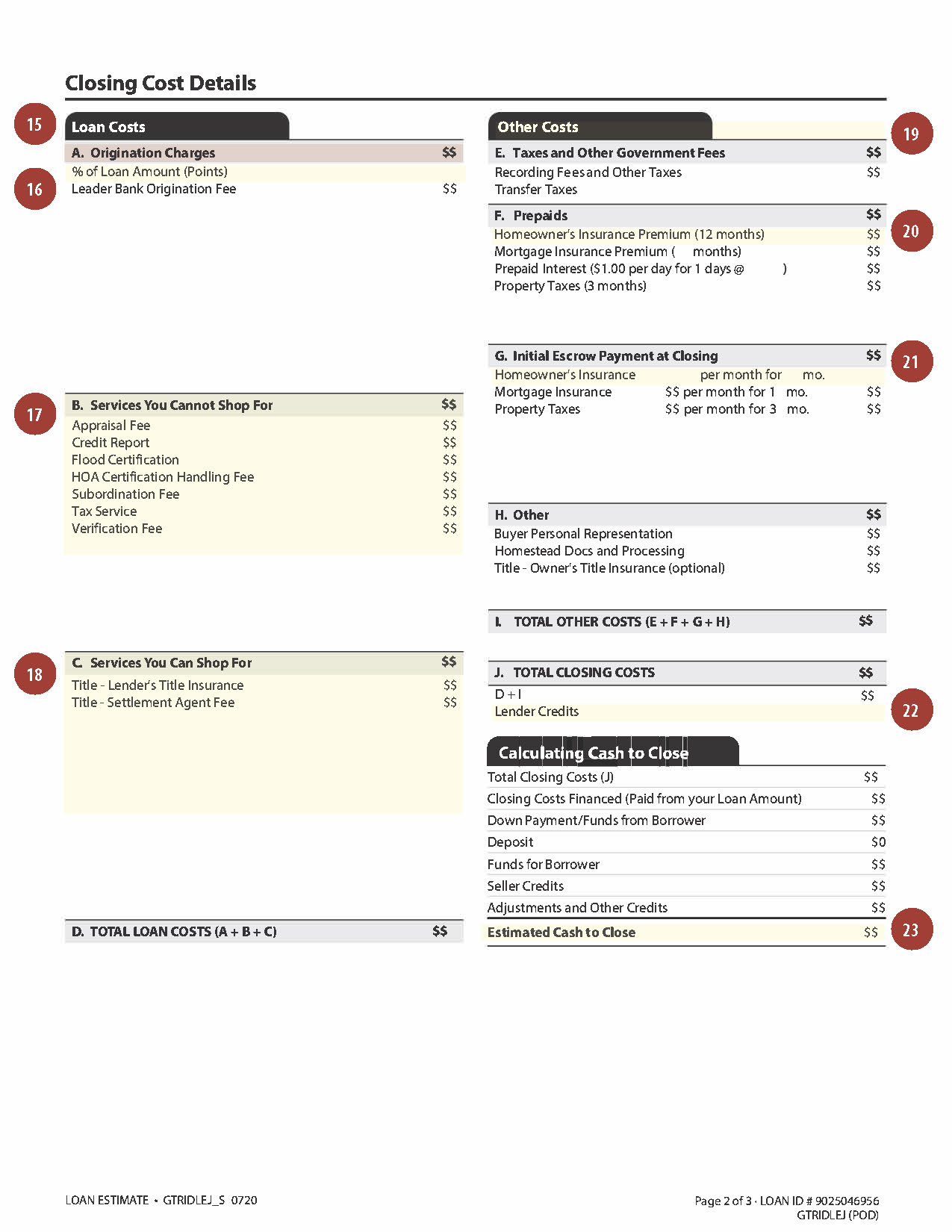

15. Origination charges are upfront fees charged by your lender as part of your closing costs.

16. Points are an optional upfront fee in which you pay your lender for a lower interest rate.

17. The services outlined in this section are chosen by your lender and required to obtain a loan from them. While there are some services you can shop around for to obtain the best price (see below), the services listed in this section are non-negotiable.

18. While the services listed in this section are required to obtain a loan, your lender will allow you to shop around for providers who can offer you the most competitive price. Your lender may offer you a list of providers they regularly work with for these services.

19. This section outlines additional costs associated with your transaction necessary to complete the transfer of property.

20. This section includes costs that must be paid upfront a closing, including prepayment of a 12-month period of homeowners insurance, mortgage insurance, interest, and three months of property taxes.

21. The figures in this section show you what insurance and tax costs are due at closing. You can double check that these are correct by reaching out to the tax authority in your new town or city.

22. If you received a rebate or credit from your lender to offset some or all of your closing costs, that figure will be represented here.

23. This figure represents the total funds you will need to pay at closing. This section of your loan estimate will provide line items detailing how your estimated cash to close amount was calculated.

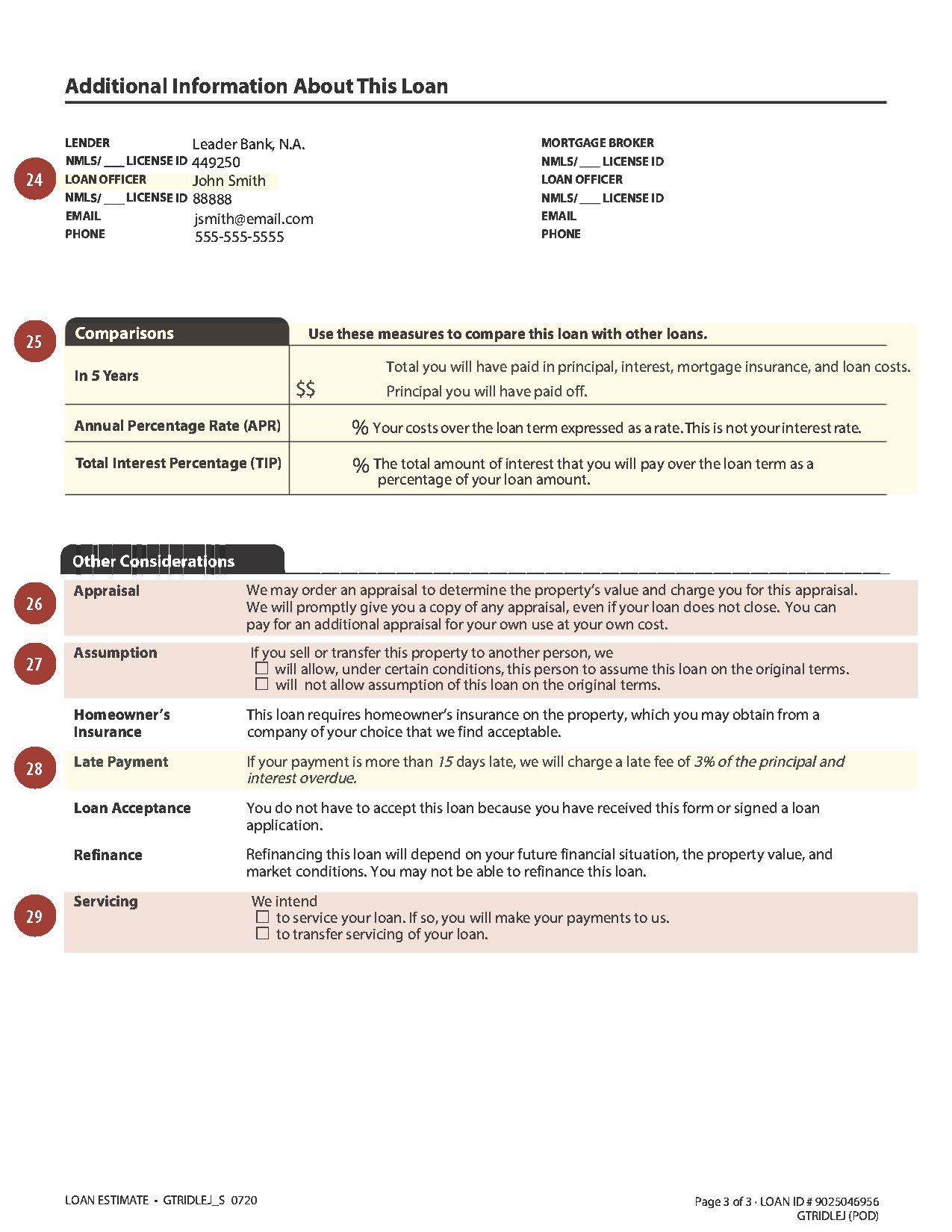

24. Double check that the Loan Officer listed here is the same one that you've been working with throughout the process.

25. This section provides insight into how much you will have paid on your loan in five years, your APR (the cost of your loan), and your Total Interest Percentage which indicates how much interest you'll pay over the life of your loan. This information can be helpful when you're shopping around for the most competitive loan terms.

26. An appraisal will be conducted by your lender to determine the value of the property. You'll receive a copy of the appraisal report once completed.

27. An assumption indicates that if you sell your home the buyer can take over your loan on the same terms. Most loans do not have assumptions.

28. Any fees for making a late payment on your loan will be outlined here.

29. Loan Servicing is the day-to-day management of your loan including collecting payments and answering any questions you may have about your loan. Some lenders service loans themselves while others transfer that responsibility to a different company.